Insurance Card OCR with Benefit Verification

AI & OCR powered insurance Card capture and insurance verification eliminates the existing manual capture and verify methods.

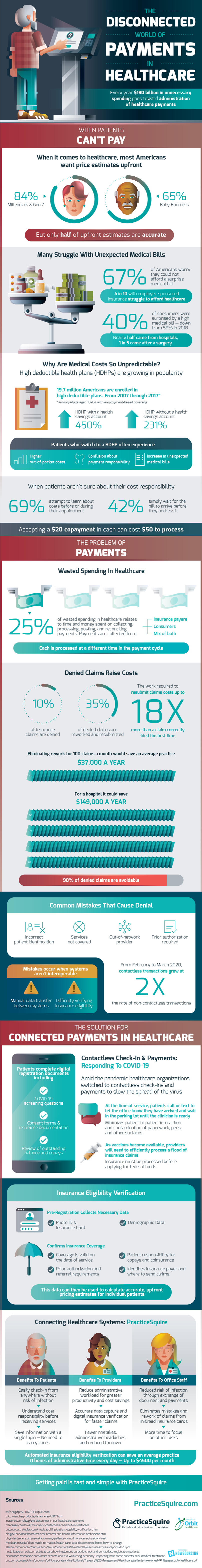

Insurance Card OCR API may be embedded into existing home grown applications or replace existing intake workflow with digital intake experience. Collecting payments on the payer side and going to the doctor during COVID-19 has become increasingly complex and disconnected. Find out more about insurance card image processing with eligibility in the following infographic deep dive below:

Share this graphic on your site!

Copied!

- High Costs & Confusion

-

- When it comes to healthcare, most Americans want price estimates upfront

- Millennials & Gen Z: 84%

- Baby Boomers: 65%

-

- BUT only half of upfront estimates are accurate

- When it comes to healthcare, most Americans want price estimates upfront

- Many Struggle With Unexpected Medical Bills

-

-

- 67% of Amerians worry they could not afford a surprise medical bill

- 4 in 10 with employer-sponsored insurance struggle to afford healthcare

- In 2019, 40% of consumers were surprised by a high medical bill — down from 59% in 2018

- Nearly half came from hospitals

- 1 in 5 came after a surgery

- 67% of Amerians worry they could not afford a surprise medical bill

-

- Why Are Medical Costs So Unpredictable?

-

-

- High deductible health plans (HDHPs) are growing in popularity

- 19.7 million Americans are enrolled in high deductible plans

- From 2007 through 2017*

- HDHP with a health savings account: +450%

- HDHP without a health savings account: +231%

- From 2007 through 2017*

- HDHPs bring

- Higher out-of-pocket costs

- Confusion about payment responsibility

- Increase in unexpected medical bills

- 19.7 million Americans are enrolled in high deductible plans

- High deductible health plans (HDHPs) are growing in popularity

-

- When Patients Can’t Pay

-

- When patients aren’t sure about their cost responsibility

- 69% attempt to learn about costs before or during their appointment

- 42% simply wait for the bill to arrive before they address it

- When patients aren’t sure about their cost responsibility

- Nearly 25% of wasted spending in healthcare relates to time and money spent of collecting, processing, posting, and reconciling payments

-

-

- Payments are collected from

- Insurance payers

- Consumers

- Mix of both

-

- Each is processed at a different time in the payment cycle

- Payments are collected from

-

- Denied Claims Raise Costs

-

- Up to 10% of insurance claims are denied

- 35% of denied claims are reworked and resubmitted

- The work required to resubmit claims costs up to 18X more than a claim correctly filed the first time

- Up to 10% of insurance claims are denied

-

- 90% of denied claims are avoidable

- Common Mistakes That Cause Denial

-

-

-

- Incorrect patient identifier

- Services not covered

- Out-of-network provider

- Prior authorization required

- Mistakes occur when systems aren’t interoperable

- Manual data transfer between systems

- Difficulty verifying insurance eligibility

-

-

- “Even though billions of dollars have been invested in EMR interoperability, it’s still not there today . . . If everyone’s not on the same EMR, then going outside your four walls, on the provider side, is really an immense challenge.” — Chris Goldsmith, President of Landmark Health

-

- Contactless Check-In & Payments: Responding To COVID-19

- Amid the pandemic healthcare organizations switched to contactless check-ins and payments to slow the spread of the virus

- Patients complete digital registration documents including

- COVID-19 screening questions

- Consent forms & insurance documentation

- Review of outstanding balance and copays

- At the time of service, patient call or text to let the office know they have arrived and wait in the parking lot until the clinician is ready

- Minimizes patient to patient interaction and contamination of paperwork, pens, and other surfaces

- Patients complete digital registration documents including

- As vaccines become available, providers will need to efficiently process a flood of insurance claims

- Eligibility must be processed before applying for federal funds

- Amid the pandemic healthcare organizations switched to contactless check-ins and payments to slow the spread of the virus

- Contactless Check-In & Payments: Responding To COVID-19

- Insurance Eligibility Verification: The Key To Upfront Cost Estimates

-

-

- Pre-Registration Collects Necessary Data

- Photo ID & Insurance Card

- Demographic Data

- Confirms Insurance Coverage

- Coverage is valid on the date of service

- Patient responsibility for copays and coinsurance

- Prior authorization and referral requirements

- This data can then be used to calculate accurate, upfront pricing estimates for individual patients

- Pre-Registration Collects Necessary Data

-

- Connecting Healthcare Systems: PracticeSquire

- Benefits To Patients

-

-

-

- Easily check-in from anyway without risk of infection

- Know cost responsibility before receiving services

- Save information with a single login — No need to carry cards

-

-

- Benefits To Providers

-

-

-

- Reduce administrative workload for greater productivity and cost savings

- Accurate data capture and digital insurance verification for faster claims

- Fewer mistakes, administrative headaches, and reduced turnover

-

-

- Benefits To Office Staff

-

-

- Reduced risk of infection through exchange of document and payments

- Eliminates mistakes and rework of claims from misread insurance cards

- More time to focus on other tasks

-